Create your first automation in just a few minutes.Try Studio Web →

UiPath Financial Spreading for Banks Accelerator

by YouTube

0

Solution

<100

Summary

Summary

Amplify your credit analysis teams and close more business loans using auto extraction from Financial Statements

Overview

Overview

Description

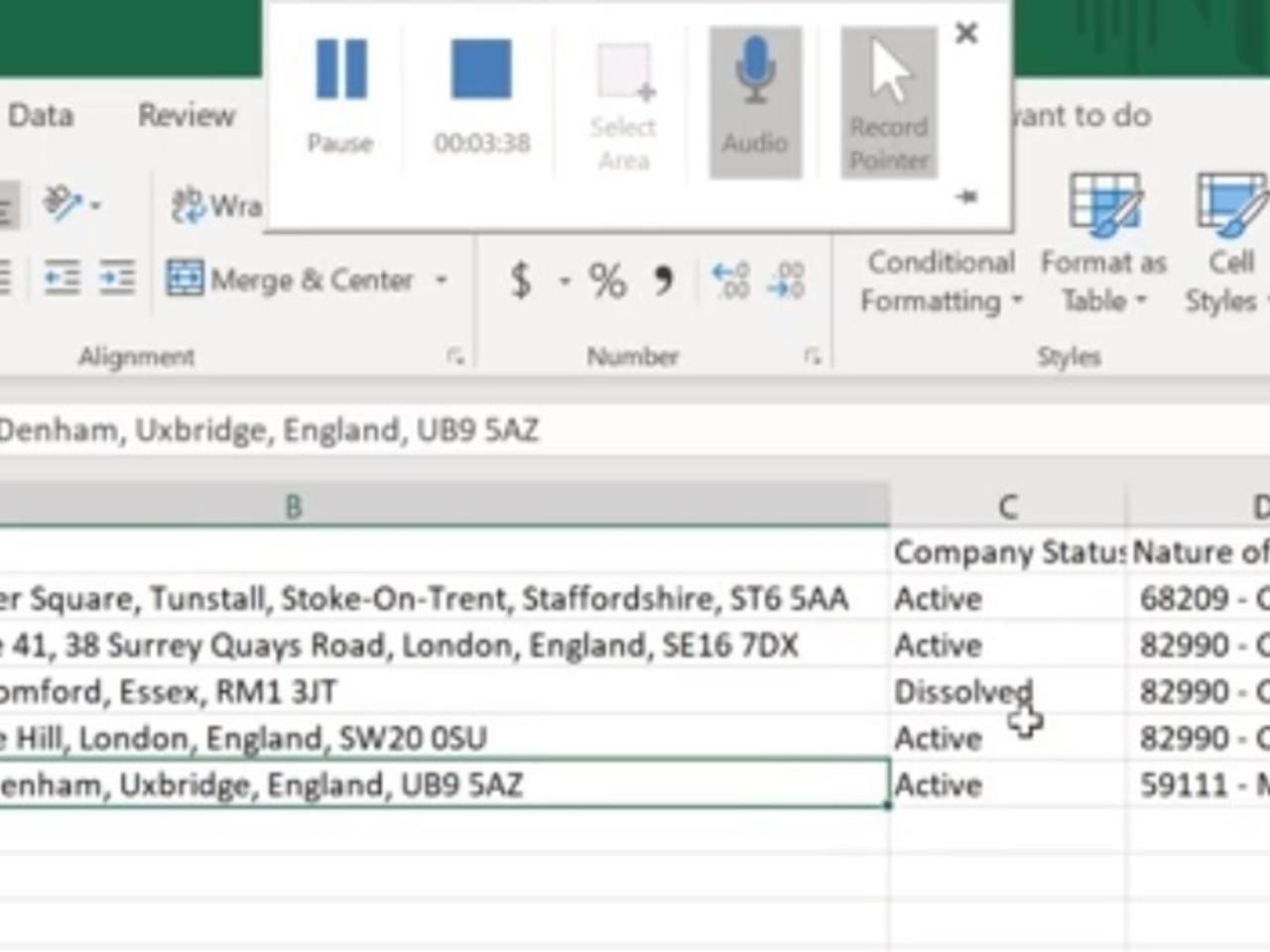

Wholesale Banking underwriting teams require information extraction from customer documents for small and medium business loans. These financials are submitted in varying forms. Typically, these documents are scanned, put through OCR and then typically manually extracted leading to longer timelines for loan approval. Apart from operational efficiency, automation also allows banks to amplify their credit analysis teams, i.e. ability to approve and close more loans with same levels of staff. This accelerator assists in automation of process steps within the Financial Spreading process as part of overall lending lifecycle. The automation journey begins with UiPath Robot picking up each of the balance sheet documents submitted by a prospect. Thereafter, UiPath Robot invokes Evolution AI API in order to extract key financials from each of these balance sheets. Evolution AI API returns the set of extracted fields back to UiPath Robot. Thereafter, UiPath Robot uses Company's registration number and extracts additional information about the company from 3rd party website (UK Company House in this case). Once all the required information has been extracted, UiPath Robot prepares a pre formatted spreadsheet for Credit Analysis.

Features

Features

Reduces the burden on credit analysts to process voluminous physical customer applications and repeated data entry into underwriting systems. This directly impacts the turnaround time for loan decisioning. Additionally, this automation also removes any Subjectivity while performing financial spreading that may lead to differential treatment to customers having similar profile. Apart from operational efficiency, automation also allows banks to amplify their credit analysis teams, i.e. ability to approve and close more loans with same levels of staff.

Additional Information

Additional Information

Dependencies

Evolution AI